- 1 Submit Online

- 2 Fast Lender Approval

- 3 Cash in Your Account

Personal Loans for Good or BAD Credit Score - 100% Online

How to get a personal loan if you have a bad credit?

We are sure you’ve often heard such notions as “good credit” and “bad credit”. Do you want to know what it means? Of course, you do. As it will help you to become a more wanted trusted borrower. Good or bad credit depends on your credit account history. It is gathered and processed by credit reporting agencies, which compile your annual report. If it contains positive information, you are said to have good credit, if there’s a lot of negative information, such as defaulting loans, late payments, etc. you are a bad credit borrower.

Bad credit can affect more than your chances to borrow. With good credit you’ll have more opportunities to find a good job, to buy a car or to rent a flat. That’s why you need to understand how the financial system measures your credit score. A credit score is used to quantify how risky a borrower you are. Banks and credit card companies use it to see if they want to lend to you.

What influences a Credit Score?

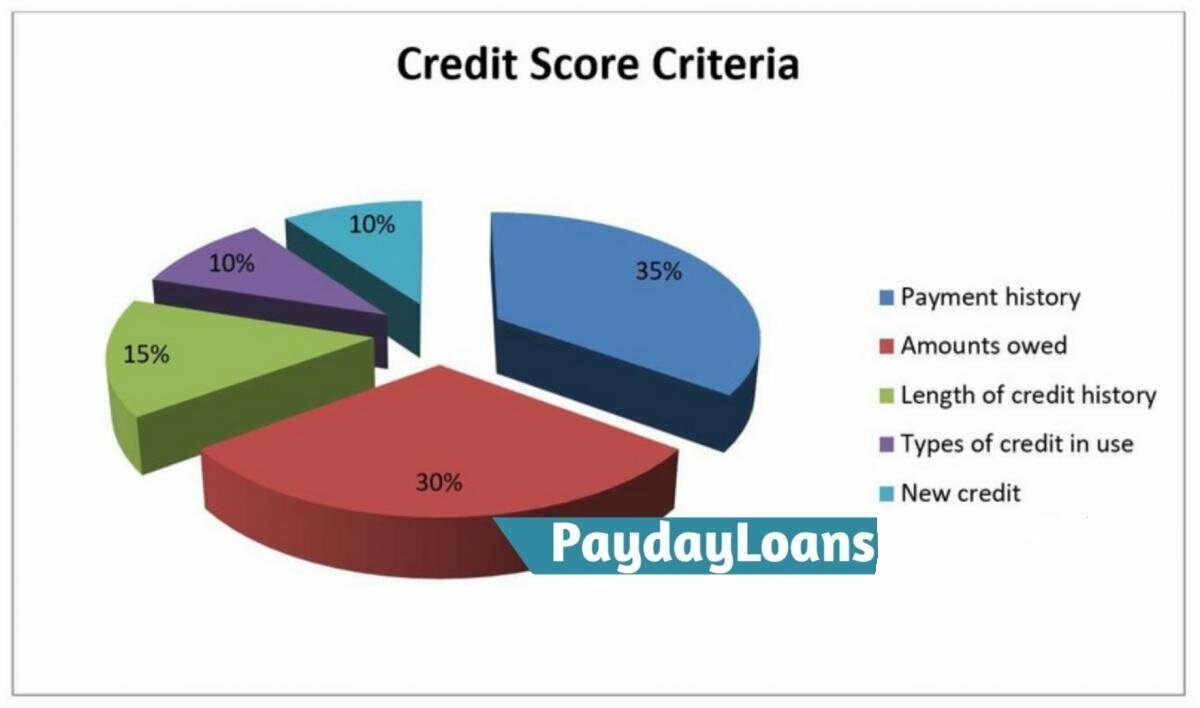

There exist several ways to count a credit score. But 90% of lending organizations use a FICO score. It’s named after a Fair Isaacs Corporation. The main criteria taken into account to measure it are shown in the diagram below:

According to these factors you are considered to be a risky or safe borrower. Do you want to know what group you belong to? Read further for details.

You are considered risky if: |

You are considered safe if: |

|

|

Poor, fair, good, very good or excellent credit score.

The FICO score ranges between 300 and 850. The higher the score the more chances to get approved you have. According to its number all the consumers can be divided into several groups.

Credit title |

Poor |

Fair |

Good |

Very good |

Exceptional |

Credit score |

300-579 | 580-669 | 670-739 | 740-799 | 800+ |

What does it mean? |

You may be rejected. Or you may need to pay a fee or a deposit. | To get approved may be rather difficult, and the rates are likely to be higher. | You are an “acceptable” borrower. | You may get better interest rates from lenders. | You will be easily approved for a loan. |

27% of people have a very good score while only 2% - poor. The highest average score is in Wisconsin, the lowest – in Mississippi. Still any US resident with financial difficulties can apply and get approved for a loan. Those with very good or even exceptional score may qualify for any type, amount and lower rates loans, while the others can get a payday, personal or installment loan.

Can I take a Personal Loan if I have a poor or fair credit score?

- Do you as many other US residents sometimes face financial difficulties?

- Do you have not a very good credit score?

- Do you feel inconvenient or even ashamed to ask your friends or relatives for help?

- Do you want to know how to borrow a necessary sum of money even with a poor credit score?

Of course, you do! And we can help you with it.

We offer 24/7 service 100% online in all the States. You are a resident of the US, over 18, with a permanent job and valid bank account – you are definitely our client.

Your credit score is fair or even poor. You’ve tried everything: banks, credit unions, etc but in vain. You are not the only one with such a problem. Just imagine, you can solve it with one click on the “Apply now” button on our web-site.

We work with more than 300 direct lenders and are always ready to choose the one that suits your individual needs and conditions. Sounds good? Check this out. Take $100-$1000 payday loan, installment loans in the amount of $1000-$5000 and personal loans up to $15000. without any collateral or guarantor with 80% approval even for bad credit applicants.

Need more?

Read further to find out even better news. Our partners look at the overall situation, and not only your credit. In fact some of them have their own credit score model. Besides they take into account your education, employment history, etc.

How do I get approved for a Personal Loan Online?

Want to see how it works right now?

You fill out a simple application form online mentioning the necessary amount, your zip code and e-mail address. It takes less than a minute. We redirect it to the lender choosing the most reliable and suitable one. He processes information couple of minutes. Don’t worry. It’s absolutely safe and confidential. And if you are approved by the lender, the money is deposited into your account within one business day.

How can a poor credit score influence getting a personal loan?

Believe it or not, personal loans up to $15000 are available for borrowers with a bad credit. Though you score can influence the amount you want to take and the interest rate the lender will offer you. The maximum sum for an installment cash advance is $5000, and for a personal loan - $15000. In the majority of cases, you need no collateral, no guarantor, no paperwork. Money is yours without any additional paperwork, driving, waiting in lines. No matter whether your credit score is 400, 550, or 600, let us help you to find a suitable reliable lender. So give it a go.

To sum it up, look at your options in a more vivid way:

I need $10000 or $15000

I have 300-740 credit score I have 750-800 score

1. Apply for a payday loan

2. Apply for an installment loan

3. Apply for a personal loan which can be with a rather high interest rate and may require a collateral or guarantor

4. Improve your credit.

1. Apply for any kind of a loan and be sure to get approved even for the maximum amount

How can I improve my credit score?

The good news is that you don’t have to possess an excellent score to be approved for a personal loan. A poor credit is not a verdict. It’s up to you to make things better and life easier. All you need is knowledge. And money. And we know how to give you both. Read through the main tips how to improve your credit score:

- Do not default your loans, pay your bills on time.

- Take care of your credit card balance. It can influence your score more than any other type of personal loans for example.

- Do not exceed your credit card maximum, use less than 10% of it. If your credit is $10000, don’t spend more than $1000.

- Consolidate your debt on one credit card.

- Take care of your credit report. You may get it free every year online at annualcreditreport.com or by phone 1-877-322-8228. Double-check all the data and numbers. Let the lenders know about any mistakes.

To do it is easier than you think. Following these simple pieces of advice you’ll be able to control your credit score. It will definitely lead to its improvement which means you’ll get an opportunity to borrow more money at lower rates. Trust us, it’ll be worth it.